Source: Investor Relations

(02 March 2011. Pasay City, Philippines.) Philippine conglomerate SM Investments Corporation (SM) reported a 15% growth in net income for 2010 of Php18.4 billion. Consolidated revenues increased by 12% to Php179.3 billion from Php160.1 billion in 2009.

SM president Mr. Harley T. Sy said, “The better-than-expected 2010 results demonstrate the ability of SM to benefit from an economic resurgence. The Philippine economy was particularly robust last year and most of our core businesses manifested that with their strong performance. We now look forward to bigger opportunities as we enter this new decade. Your company is ready to further expand into new markets and enhance shareholder value.”

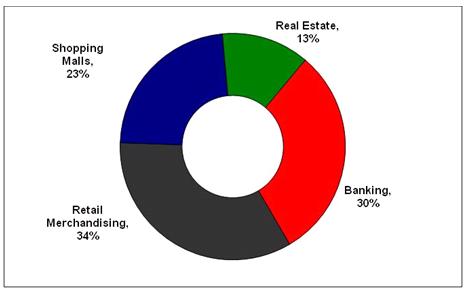

Net Income Profile

Among SM’s core businesses, the retail group gave the most to SM’s 2010 profits with a 34% contribution. The banking group came in second with 30%, followed by shopping malls and real estate, which contributed 23% and 13%, respectively.

RETAIL OPERATIONS

While the retail group forged ahead with its expansion program, it reaped the benefits of its existing network of stores from a more robust consumer spending environment. Consequently, the group reported a full-year 2010 net income of Php5.6 billion, up 25.2%, resulting in an expanded net margin of 4.2%, from 3.6% the previous year. Total sales for the group grew 9.1% to Php135.1 billion.

SM Retail opened 28 new stores in 2010, for a total number of 142 stores by the end of the year. The total consists of 40 department stores for the non-food group; 102 for the food group, of which there were 30 supermarkets; 40 SaveMore branches; 25 hypermarkets; and seven Makro outlets.

MALL OPERATIONS

SM Prime Holdings, Inc. (SM Prime)

SM Prime also reported better-than-expected results with a 12% growth in consolidated net income to Php7.9 billion from full-year 2010, as compared to Php7.0 billion during the same period in 2009. Revenues for the period rose by 16% to Php23.7 billion. EBITDA increased 14% to Php15.9 billion. These results include the operations of the three SM malls in China, which are located in the cities of Xiamen and Jinjiang in Southern China, and Chengdu in Central China.

BANKING AND FINANCIAL SERVICES

Banco De Oro Unibank, Inc. (BDO)

BDO ended 2010 with a net income of Php8.8 billion, up 46% from the Php6.0 billion it earned a year before, and exceeding its initial earnings guidance of Php8.1 billion. The bank reported that its consolidated resources hit the Php1.0 trillion mark at the end of 2010, making it the first Philippine bank to achieve that milestone. Capital Adequacy Ratio (CAR) remained sound at 14%, well above the current regulatory minimum of 10%.

China Banking Corporation (CHIB or China Bank)

China Bank reported a 22% growth in net income for 2010 to Php5.0 billion. This strong income performance was driven by continued loans growth and improved trading gains.

The bank’s total revenues grew to Php17.9 billion. Net interest income improved by 5% to Php8.6 billion as interest expense decreased by 12% due to lower borrowing rates. Fee-based income increased by 14% to Php4.7 billion, boosted by higher trading gains, which grew 47% to Php1.8 billion. China Bank continued to be one of the most cost-efficient banks in the industry with a cost efficiency ratio of 54% from 56%.

REAL ESTATE DEVELOPMENT

Revenues from real estate operations for full-year 2010 increased 41% to Php13.0 billion, while net income grew 44% to Php3.7 billion. Consolidated net income, on the other hand, rose 39% to Php3.8 billion.

SM Development Corporation (SMDC)

It was another stellar year for SMDC, which reported a 62% increase in consolidated net income to Php3.0 billion from just Php1.9 billion in 2009. Consolidated revenues reached Php10.0 billion, significantly higher by 74%, year-on-year.

SMDC has a current portfolio of 14 residential projects, 13 of which are in Metro Manila and one in Tagaytay City in the Province of Cavite.